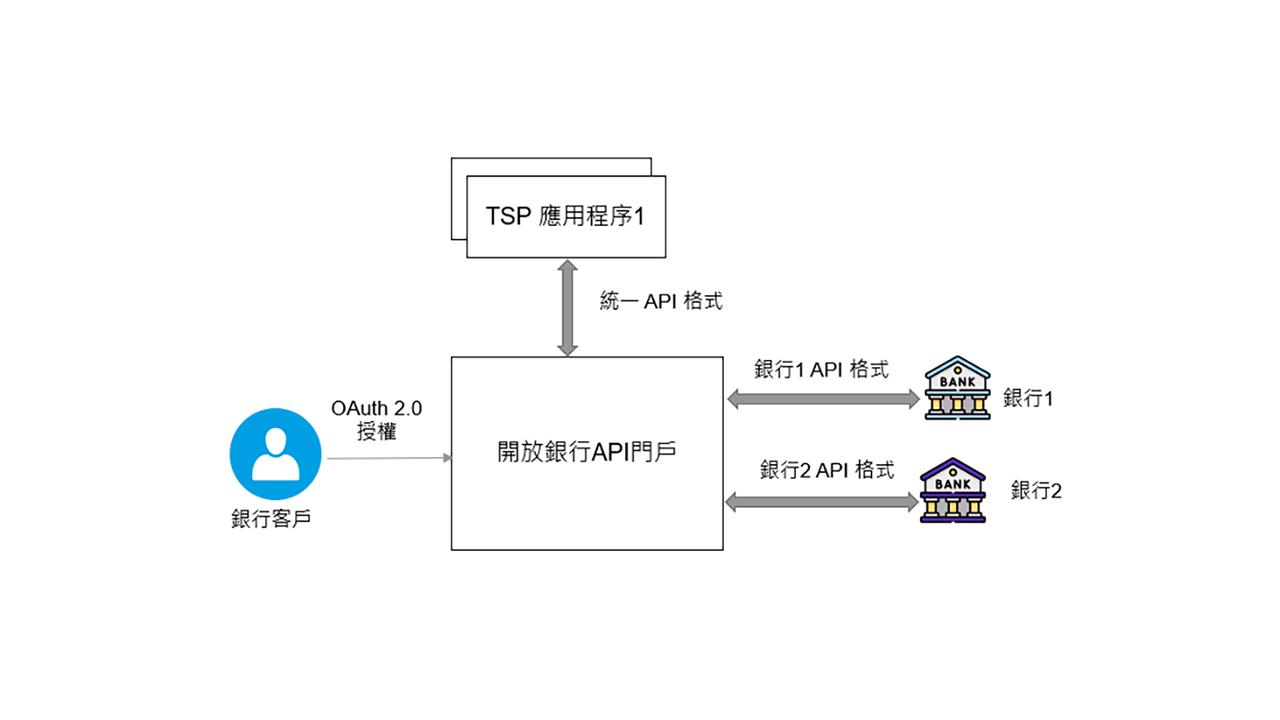

Open Banking API Portal Connecting TSP to Bank Systems

ASTRI develops an open banking API bridge portal in order to support HKMA’s initiative. It provides a unified API interface to third-party service providers (TSP) for accessing various bank systems with bank client authorization. The portal maps the unified API with different APIs of different banks. The portal also serves as a platform for dynamically deploying Fintech applications. ASTRI also develops plug-and-play interface for dynamic deployment of TSP services to the API bridge portal.

There is a high barrier to developing fintech applications for accessing accounts of different banks because the bank clients can only use applications provided by banks to access their bank accounts. Also, it deters the introduction of innovative Fintech applications by third parties.

Modular architecture enables:

-Dynamic addition of bridge connectivity to new bank systems

-Dynamic deployment of TSP Fintech applications

Applies OAuth 2.0 authorization framework to enable bank clients to specify the scope of operations the API bridge portal can do with their bank accounts. Also, implementing the framework can allow bank clients to examine the list of deployed TSP applications and select the ones to subscribe.

Supports TSP applications in the form of Web or mobile phone application

- Enriches bank & Fintech innovation ecology through the inclusion of TSP developed solutions

- Empowers bank clients to better manage and utilize bank assets by accessing their bank accounts in all banks through the portal

- Enables close interoperation of bank system with other systems for greater application capability and scope

- Promotes collaboration between bank industry and Fintech industry

- Credit assessment on bank transactions

- Investment advising and execution service on bank account assets

- Mobile payment application with credit card recommendation powered by bank account information analysis

Patent

- US App. No. 17/858,508

Hong Kong Applied Science and Technology Research Institute (ASTRI) was founded by the Government of the Hong Kong Special Administrative Region in 2000 with the mission of enhancing Hong Kong’s competitiveness through applied research. ASTRI’s core R&D competence in various areas is grouped under four Technology Divisions: Trust and AI Technologies; Communications Technologies; IoT Sensing and AI Technologies and Integrated Circuits and Systems. It is applied across six core areas which are Smart City, Financial Technologies, New-Industrialisation and Intelligent Manufacturing, Digital Health, Application Specific Integrated Circuits and Metaverse.